How to Calculate Forex Risk per Trade

Managing risk is a vital skill for every forex trader, especially beginners. Calculating Forex Risk per Trade ensures you don’t expose too much of your trading account to unnecessary losses.

By understanding how much you stand to lose or gain in a single trade, you can make more informed decisions. Let’s dive into this essential concept with examples and simple steps.

What is Forex Risk per Trade?

Forex Risk per Trade refers to the amount of money you are willing to risk on a single position. It’s usually expressed as a percentage of your total trading account balance.

For instance:

If your account balance is $10,000, and you decide to risk 2% per trade, you’re putting $200 at risk for that trade.

Why does this matter? Risking too much could wipe out your account quickly. On the other hand, managing risk carefully can help you trade consistently and stay in the market longer.

Why Calculating Forex Risk per Trade is Important

Trading forex involves both opportunities and risks. By calculating your Forex Risk per Trade, you can:

- Protect your capital from significant losses.

- Maintain a consistent approach to trading.

- Avoid emotional decisions during market volatility.

Besides that, knowing your risk allows you to plan trades with realistic goals and achievable stop-loss levels.

Steps to Calculate Forex Risk per Trade

Here’s a step-by-step guide to calculating your Forex Risk per Trade.

1. Decide on Your Risk Percentage

The first step is to decide what percentage of your account you’re willing to risk. For beginners, 1-2% per trade is recommended.

This conservative approach ensures you won’t lose all your money quickly, even if you have a string of losing trades.

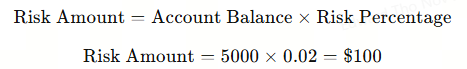

Example:

If your account balance is $5,000, and you risk 2% per trade:

This means you’re risking $100 per trade.

2. Determine Your Stop-Loss Level

Next, decide where you’ll place your stop-loss. The stop-loss is the price level at which you’ll exit the trade if it moves against you. The difference between your entry price and stop-loss price determines your risk in pips.

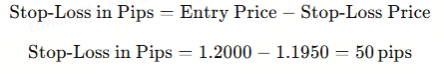

Example:

If you enter a trade at 1.2000 and set your stop-loss at 1.1950:

You’re risking 50 pips in this trade.

3. Calculate Your Lot Size

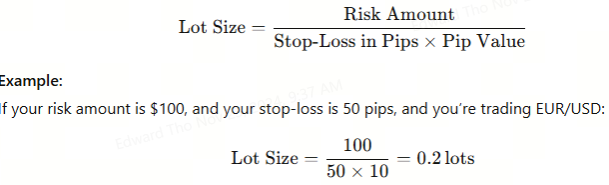

To ensure your risk aligns with your desired amount, calculate the correct lot size. Lot size determines the monetary value of each pip movement.

A standard lot equals $10 per pip, while mini lots are $1 per pip, and micro lots are $0.10 per pip.

Formula:

This means you should trade 0.2 standard lots (or two mini lots).

Practical Tips for Managing Forex Risk per Trade

- Stick to Your Plan

It’s tempting to increase risk after a profitable streak. But remember, consistency is key. Stick to your pre-determined percentage risk for every trade.

2. Adjust for Market Conditions

If market volatility is high, you may need to set a wider stop-loss. However, this means you’ll have to reduce your lot size to keep your Forex Risk per Trade within your set limit.

3. Use a Forex Risk Calculator

If you’re not comfortable with manual calculations, use an online forex risk calculator. These tools can quickly calculate lot size based on your inputs.

Common Mistakes to Avoid

- Overleveraging: Trading too large can amplify losses. Stay within your risk limits.

- Ignoring Risk: Skipping this step often leads to blowing up accounts.

- Moving Stop-Loss Levels: Never widen your stop-loss once a trade is live; it defeats the purpose of risk management.

Conclusion

Calculating Forex Risk per Trade is a foundational skill every trader should master. It ensures your trading strategy is grounded in discipline and helps protect your capital.

By following the steps outlined here, you can take control of your trading and approach the forex market with confidence.

Remember, consistent risk management is the backbone of successful trading.

Start small, practise regularly, and watch your skills grow over time.