Economic Calendars in Forex

Trading Forex can feel overwhelming, especially for beginners. However, one tool can simplify your trading experience: economic calendars.

These calendars highlight critical financial events that affect currency movements, helping traders plan their strategies. For instance, if a major central bank announces an interest rate hike, currencies might react strongly.

But how can you make the most of this tool? Let’s find out more.

What is an Economic Calendar?

An economic calendar lists key financial events scheduled for specific dates. These events often include:

- Interest rate decisions (e.g., Federal Reserve meetings).

- Employment reports, like the U.S. Non-Farm Payrolls.

- Inflation data, such as Consumer Price Index (CPI) releases.

- Gross Domestic Product (GDP) updates.

Traders use this information to predict market movements. For example, if the European Central Bank (ECB) is expected to raise rates, the EUR/USD pair might rally in anticipation.

Why are Economic Calendars Important in Forex?

Forex markets thrive on volatility, and economic calendars predict when volatility will spike. Here’s why they’re crucial:

- Anticipating market movement: Knowing when events like job reports or rate decisions occur can prepare traders for sharp price swings.

- Timing trades effectively: A well-timed trade before an event can maximise profits. However, some traders avoid events altogether due to the unpredictability.

- Understanding trends: Economic calendars reveal patterns over time, giving insights into recurring trends.

Example:

Suppose the U.S. Federal Reserve announces interest rate changes on December 15. The USD may strengthen if rates increase because higher rates often attract investors seeking better returns.

How to Use an Economic Calendar

1. Choose the right economic calendar

Find an accurate and user-friendly economic calendar. Many brokers, like VT Markets, offer free economic calendars on their platforms.

2. Filter events by impact

Calendars often categorise events as low, medium, or high impact. Beginners should focus on high-impact events, as these typically drive the most price movement.

3. Understand the data in economic calendars

Economic calendars display several columns:

- Time and date: When the event occurs.

- Event name: The type of data release (e.g., CPI report).

- Previous value: The last reported figure.

- Forecast: Analysts’ expectations.

- Actual value: The released data.

Example:

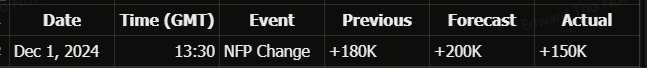

The Non-Farm Payrolls (NFP) report is a high-impact event. Here’s how the calendar may look:

If the actual figure is lower than forecast, the USD might weaken as it signals a slowing economy.

Economic Calendars in Forex: Practical Tips

1. Plan your trades with economic calendars

Avoid opening positions during high-volatility events if you dislike risks. Alternatively, trade with smaller lot sizes to limit exposure.

2. Combine with technical analysis

Economic calendars work well with charts. For example, if an event suggests bullish momentum for the USD, confirm it with technical indicators like moving averages or RSI.

3. Stay updated

Economic data can change markets quickly. Check the calendar regularly to avoid surprises.

Simple Calculation Example:

Let’s say you trade EUR/USD, currently at 1.1000.

A major ECB decision predicts a 0.25% interest rate hike, potentially strengthening the EUR by 1%. This could push EUR/USD to 1.1110.

If you hold a position with 1 standard lot (100,000 units), the profit from a 110-pip move would be:

110 pips × $10 (per pip value for a standard lot) = $1,100

Economic Calendars: A Beginner’s Checklist

- Mark key dates: Prioritise high-impact events.

- Check forecasts: Compare expected and actual data.

- Adjust risk levels: Use stop-loss orders during volatile periods.

Conclusion:

Economic calendars are invaluable for traders. They provide structure, insight, and opportunity. Beginners should embrace this tool and use it to sharpen their trading strategies.

Remember, consistency and preparation are the keys to success.