Quantitative Models for Fundamental Strategies

In Forex trading, blending quantitative models with fundamental strategies offers an edge in making well-informed, data-driven decisions.

Quantitative models enable traders to back up their analysis with statistical evidence. As such, this enhances their ability to predict market movements.

In this guide, we’ll explore how advanced traders can apply quantitative models to fundamental strategies. With this approach, it can provide you with practical tools, simple calculations, and real-life examples to implement in your trading.

What are Quantitative Models?

Quantitative models are mathematical frameworks. These frameworks use historical data and statistical methods to analyze and forecast market trends.

In trading, these models are particularly valuable when combined with fundamental strategies. These methods focus on understanding the underlying economic factors that affect currency prices.

By adding a quantitative approach, traders can better assess the strength of their fundamental analysis and minimize subjective bias.

For example:

A simple quantitative model might involve calculating the correlation between interest rates and currency value. This technique uses historical data to forecast how future changes might affect forex pairs.

Integrating Quantitative Models with Fundamental Strategies

When combining quantitative models with fundamental analysis, the key is to enhance your insight into economic indicators.

Traders often use fundamental strategies to monitor and evaluate key reports such as GDP growth, unemployment rates, and inflation.

However, by using quantitative models, they can filter out noise, identify trends, and make more objective, data-backed predictions.

Let’s break this down further.

1. Using Quantitative Models to Test Economic Theories

Advanced traders often rely on economic theories to predict market movements.

For instance:

The theory of purchasing power parity (PPP) suggests that exchange rates should adjust to reflect changes in price levels between countries. A quantitative model can be built to test this theory over time.

Example:

Suppose you’re tracking two countries with a rising inflation rate. The quantitative model could involve:

- Data from the last 10 years showing how inflation rates correlate with exchange rate changes.

- A regression model predicting the expected exchange rate change if inflation in one country increases by 1%.

This statistical approach gives you a clearer picture of how inflation influences currency values rather than relying on instinct or non-quantitative observations.

2. Developing Predictive Models Based on Economic Data

Quantitative models can take fundamental data and apply predictive algorithms. These models allow traders to generate forecasts about how specific events, like an interest rate hike, may affect the forex market.

Example:

Let’s say you’re trading the EUR/USD pair.

If the European Central Bank (ECB) announces an interest rate change, you could use a quantitative model that factors in the historical market reactions to similar changes.

This model might predict a 2% increase in the euro’s value following an interest rate hike based on data from the past five years.

By using a quantitative model, you get a numerical forecast. Such a forecast helps you prepare for potential price movements rather than relying on subjective predictions.

Types of Quantitative Models for Fundamental Strategies

There are several types of quantitative models traders can use to complement their fundamental analysis. Let’s dive into some popular options.

1. Time Series Models

Time series models are used to analyze data points collected over time, such as historical currency prices or economic indicators like unemployment rates. These models use past data to predict future movements.

Example Calculation:

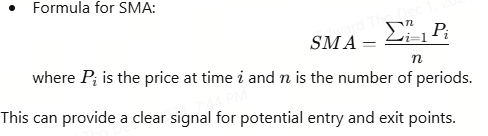

If you’re tracking the USD/JPY pair and using a time series model, you might use a simple moving average (SMA) to smooth out price fluctuations.

By calculating the average price over the last 30 days, you can identify whether the trend is upward or downward.

2. Regression Models

Regression analysis helps to determine the relationship between different variables, such as interest rates and currency value. This method quantifies how one factor (e.g., economic growth) can influence another (e.g., currency strength).

Example Calculation:

Let’s say you want to model how GDP growth affects currency strength. You can use a simple linear regression formula:

Y=a+bXY = a + bX

Where:

- YY is the predicted currency value.

- aa is the intercept (constant).

- bb is the coefficient (how much the GDP growth rate affects the currency).

- XX is the GDP growth rate.

With this model, you could forecast how a 1% increase in GDP might impact the currency pair.

Practical Tips for Using Quantitative Models in Forex Trading

Incorporating quantitative models into your trading strategy requires the right approach and mindset.

Here are some tips to help you effectively apply these models:

- Backtest your models. Before applying any quantitative model in live trading, backtest it using historical data to assess its accuracy and reliability.

- Combine with qualitative analysis. While quantitative models provide valuable data-driven insights, don’t disregard qualitative factors like geopolitical risks, central bank decisions, or market sentiment.

- Understand model limitations. No model is perfect. Always be prepared for unexpected market conditions and avoid over-relying on any single model.

- Stay updated. Regularly update your models with new data to ensure they remain relevant and effective as market conditions change.

Conclusion

Quantitative models offer advanced traders an edge when combined with traditional fundamental strategies. By using data-driven approaches, you can refine your analysis, improve your decision-making process, and make more accurate predictions about market movements.

Whether you’re using time series models to smooth out price data or regression models to quantify economic relationships, integrating quantitative techniques will enhance your forex trading strategies.

By testing and adapting your models, you’ll position yourself for smarter, more informed trades in today’s fast-paced forex markets.