Forex Volatility: Adjusting Risk Exposure

Forex trading is exciting. However, Forex volatility makes it both challenging and rewarding. Understanding, managing and adjusting risk exposure to this volatility is key to successful trading.

For intermediate traders, it is a vital skill that safeguards accounts during unpredictable market conditions.

In this article, we’ll explore what forex volatility is, how it impacts trading, and practical steps to manage your risk exposure.

What is Forex Volatility?

Forex volatility refers to the rate at which currency prices fluctuate. The forex market is inherently dynamic. Thus, factors such as geopolitical events, interest rate changes, or economic data releases can amplify these movements.

For instance:

EUR/USD is often considered less volatile, with smaller daily price swings compared to GBP/JPY. The latter pair is known for larger, more unpredictable movements.

Traders targeting GBP/JPY need to adjust their strategies accordingly. It’s because of the pair’s tendency to move several hundred pips in a single session.

How Forex Volatility Affects Your Trades

Forex volatility creates opportunities, but it also increases risks. Highly volatile markets can lead to swift, dramatic changes in price. This can amplify both profits and losses, depending on your strategy.

For example:

Consider a trader using a stop-loss of 30 pips.

During a high-impact news release like a Federal Reserve interest rate decision, a currency pair could easily move 100 pips or more in minutes.

Without adjusting the stop-loss or position size, the trader risks losing more than anticipated.

Techniques to Adjust Risk Exposure During Forex Volatility

1. Adjust Position Sizes

When markets are volatile, scaling down your position size is crucial. For instance, if you usually trade a lot size of 1 on EUR/USD, reduce it to 0.5 during periods of high volatility.

For example:

Account size: $10,000

Risk per trade: 2%

Stop-loss: 50 pips

Pip value: $0.10

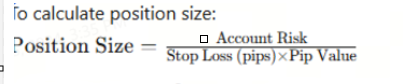

To calculate the position size:

Plugging in the values:

Account Risk = 2% of $10,000 = $200

Stop Loss = 50 pips

Pip Value = $0.10

Position Size = $200 / (50 pips x $0.10 per pip)

= $200 / $5

= 40 lots

2. Use Wider Stop-Loss Levels

During volatile conditions, price movements may exceed usual ranges. Widening your stop-loss allows your trades to breathe. But, ensure you lower position sizes to keep risk controlled.

3. Diversify Currency Pairs

Instead of focusing on a single currency pair, consider spreading trades across pairs with varying volatility. Pairing a high-volatility pair like GBP/JPY with a low-volatility pair like USD/CHF can balance risk.

Using Tools to Measure and Predict Forex Volatility

1. Average True Range (ATR)

ATR measures the average movement of a currency pair over a specific period. A rising ATR suggests higher volatility.

For instance:

If EUR/USD has an ATR of 20 pips and GBP/JPY has 80 pips, expect GBP/JPY to move four times as much.

2. Bollinger Bands

Bollinger Bands expand during high volatility and contract during low volatility. If price touches the upper or lower band, it signals potential overbought or oversold conditions.

3. Economic Calendars

Major events like interest rate decisions or GDP reports significantly impact volatility. Keeping track of these events helps you prepare for potential market turbulence.

Developing a Trading Plan for Volatile Markets

Volatile markets demand discipline and preparation. A solid trading plan includes:

- Clear Entry and Exit Strategies: Define your risk-reward ratio before placing trades.

- Backtesting: Test your strategy under historical volatile conditions to understand its performance.

- Emotion Management: Avoid overtrading or chasing losses during turbulent sessions.

For example:

During a Non-Farm Payroll (NFP) release, plan trades based on potential scenarios.

If the actual figures deviate from forecasts, expect rapid price movements. By having a clear strategy, you can act decisively.

Conclusion

Forex volatility is a double-edged sword, presenting opportunities and risks. Adjusting your risk exposure with tools like position sizing, volatility indicators, and trading plans can keep you on the profitable side of trades.

As an intermediate trader, embracing these strategies will help you navigate unpredictable markets with confidence.

Remember, trading is not about avoiding volatility but mastering it. Start implementing these techniques today and watch your trading resilience grow.