Strategic Scaling of Forex Trades for Advanced Traders

Scaling of forex trades is a powerful strategy. Advanced traders use it to maximise their profits and manage risks. By strategically increasing or decreasing the size of your positions, you can optimise returns while responding to market conditions.

This article explores how you can incorporate scaling into your trading plan. Additionally, we provide examples and calculations to guide you through this process effectively.

What is the Scaling of Forex Trades?

Scaling of forex trades refers to the practice of adjusting your position size incrementally during a trade. This technique helps traders manage risk while taking advantage of price movements.

It typically comes in two forms: scaling in and scaling out.

Scaling In

Scaling in involves entering a position gradually, adding to it as the trade moves in your favour.

For instance:

If you believe EUR/USD will rise, you might open an initial position at 1.1000. If the price reaches 1.1050 and confirms your analysis, you could add another position.

This approach is particularly useful when you’re cautiously confident about a trade but want to minimise initial exposure.

Scaling Out

Scaling out, on the other hand, is about reducing your position size as the trade progresses.

For example:

If you short GBP/USD at 1.3000 and the price drops to 1.2900, you could close half your position to secure partial profits while leaving the rest open for further potential gains.

Why Scaling of Forex Trades Works for Advanced Traders

Scaling of forex trades allows for flexibility. It helps traders optimise entries and exits, maintain emotional control, and improve overall profitability.

- Risk Management

Scaling reduces the risk of entering or exiting a position too early.

For example, if you enter a trade in smaller increments, you can better assess market direction without committing all your capital at once.

- Maximising Profit Potential

By adding to winning trades, scaling lets you capitalise on strong trends. Similarly, scaling out locks in profits incrementally, protecting your gains.

- Emotional Discipline

Scaling requires planning and discipline, reducing impulsive decisions. This leads to better trade execution over time.

Practical Strategies

Strategy 1: Scaling in with equal increments

In this approach, you add the same position size at each predefined level.

Example:

- Initial entry: Buy 1 lot of USD/JPY at 145.00.

- Add another 1 lot if the price rises to 145.50.

- Add a third lot at 146.00.

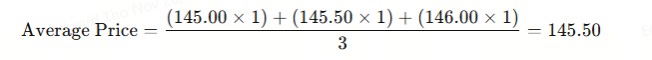

Calculation:

If the price reaches 146.50, your average entry price would be:

This strategy is simple but effective when the market moves consistently in your favour.

Strategy 2: Scaling out at resistance levels

Scaling out involves taking partial profits at predefined resistance levels.

Example:

- Short 3 lots of AUD/USD at 0.7500.

- Close 1 lot at 0.7450.

- Close another lot at 0.7400.

- Let the final lot run until 0.7350.

By scaling out, you lock in profits while leaving room for further gains if the trend continues.

Tips to Master Scaling of Forex Trades

Scaling is not a one-size-fits-all approach. It requires careful planning and testing. Here are some practical tips:

- Use a predefined plan

Decide on your scaling levels before entering the trade. This prevents impulsive decisions.

- Combine with technical analysis

Identify support and resistance levels to optimise your scaling points. For instance, use Fibonacci retracements to determine entry or exit levels.

- Maintain proper risk-to-reward ratios

Ensure each scale-in or scale-out action aligns with your overall risk management strategy. For example, never risk more than 1-2% of your capital on a single trade.

- Monitor market conditions

Adjust your scaling strategy based on market volatility. During high-volatility periods, wider scaling intervals may be more effective.

Advantages and Challenges of Scaling of Forex Trades

Advantages

- Improved flexibility: You can adjust to changing market conditions.

- Risk minimisation: Gradual entries reduce the impact of adverse price movements.

- Enhanced profits: Scaling in on strong trends magnifies returns.

Challenges

- Complexity: Managing multiple positions can be overwhelming.

- Higher transaction costs: Frequent scaling increases costs due to spreads and commissions.

- Discipline required: Without a plan, scaling can lead to overtrading.

Final Thoughts

Scaling of forex trades is a versatile strategy. Advanced traders can use it to enhance their trading outcomes. By scaling in, you can enter the market cautiously while taking advantage of favourable trends.

Similarly, scaling out helps lock in profits incrementally, protecting your gains.

However, this strategy requires planning, discipline, and a solid understanding of market dynamics. With practice, you can incorporate scaling effectively into your trading plan to achieve better risk management and profit potential.