Algorithmic Trading with MT4 Indicators

Algorithmic trading is changing the way we trade Forex. With MT4 indicators, traders can automate their strategies and make faster decisions.

These indicators analyze market data and help identify trading opportunities. In this article, we will explore how to use MT4 indicators for algorithmic trading.

You’ll learn how to set up your trading system and maximize your results. Let’s get started!

What is Algorithmic Trading with MT4 Indicators

Algorithmic trading is the use of automated scripts to execute trades based on pre-set rules. MT4 (MetaTrader 4) indicators play a key role in this process.

These indicators analyze market data in real-time. Therefore, they offer precise signals that can be translated into algorithmic strategies.

For example:

An EMA (Exponential Moving Average) crossover system might buy when a shorter EMA crosses above a longer EMA. With MT4, you can program this strategy into an algorithm, ensuring swift execution at optimal moments.

Why Advanced Traders Prefer Algorithmic Trading on MT4

MT4 stands out as a preferred platform for algorithmic trading due to its user-friendly interface, robust indicators, and expert advisor (EA) functionality.

Besides that, the ability to automate trades helps traders monitor multiple markets simultaneously.

For instance:

If you’re tracking EUR/USD, GBP/JPY, and Gold, manual analysis can be overwhelming. Algorithmic trading reduces the workload by applying MT4 indicators consistently, ensuring you never miss key trading opportunities.

Top MT4 Indicators for Algorithmic Trading

1. Moving Averages:

Moving averages (MAs) smooth price data to identify trends. A common strategy involves using a 50-period and a 200-period MA.

- Example:

If the 50-MA crosses above the 200-MA, the system generates a buy signal. Conversely, a cross below triggers a sell signal.

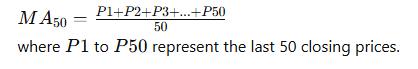

- Calculation:

For a 50-MA:

2. RSI and Stochastic Oscillators: Precision in action

The Relative Strength Index (RSI) measures overbought or oversold conditions. A stochastic oscillator, on the other hand, compares the closing price to a range of prices over a set period.

- Algorithm:

RSI > 70 = Overbought → Sell

RSI < 30 = Oversold → Buy - When combined with the stochastic oscillator, this provides high-probability entry points.

MACD: Trend and Momentum Combined

The MACD (Moving Average Convergence Divergence) indicator combines trend-following and momentum aspects. It calculates the difference between two EMAs, often the 12-day and 26-day, and includes a signal line (9-day EMA).

Example:

When MACD crosses above the signal line, the system executes a buy trade. A downward crossover triggers a sell trade.

How to Build and Backtest your Strategy with MT4 indicators

Creating an algorithmic strategy with MT4 involves these steps:

- Define your trading rules.

- Choose your MT4 indicators.

- Program your Expert Advisor (EA).

Step-by-step walkthrough with example:

Let’s say you’re using an EMA crossover strategy. You program the EA to:

- Monitor the 50-MA and 200-MA on EUR/USD.

- Buy when the 50-MA crosses above the 200-MA.

- Sell when the reverse occurs.

Backtesting example

Run this strategy on historical data from January 2024 to October 2024. Suppose the algorithm executes 200 trades:

- Wins: 120 trades at $50 profit each = $6,000.

- Losses: 80 trades at $30 loss each = $2,400.

- Net profit: $6,000 – $2,400 = $3,600.

This ensures your strategy is robust before deploying it in live markets.

Key Advantages and Challenges

Advantages :

Execute trades instantly, capturing fleeting opportunities.

- Consistency: Indicators remove emotional bias.

- Scalability: Trade multiple instruments simultaneously.

Challenges :

- Market changes: Strategies may underperform in volatile conditions.

- Technical knowledge: Building algorithms requires coding expertise.

By understanding these aspects, you can better manage risks and refine your approach.

Conclusion:

Algorithmic trading with MT4 indicators offers advanced traders unparalleled control and precision. Start by mastering the basics, experimenting with popular indicators, and backtesting your strategies.

With MT4, the possibilities are vast. Take the first step toward automation and elevate your trading game today.